Fundraising is a pivotal step for startups, providing the capital needed to grow, innovate, and capture market share. But while securing funding can unlock new opportunities, it also exposes a startup to potential risks. From intellectual property leaks to unfavorable contract terms, it’s crucial for founders to take steps to safeguard their business interests during the fundraising process. Here’s how to navigate the process with caution and confidence.

1. Define and Protect Your Intellectual Property (IP)

Your startup’s intellectual property is one of its most valuable assets, encompassing everything from proprietary technology to brand trademarks. Before you engage potential investors, ensure that your IP is well-documented, legally protected, and clearly attributed to the company. Some important actions include:

- Patents and Trademarks: If applicable, file for patents or trademarks to protect your innovations and branding. This not only secures your ownership but also boosts credibility in the eyes of investors.

- NDAs: While some investors may be reluctant to sign non-disclosure agreements (NDAs) before initial conversations, you can request an NDA before deeper, more detailed discussions. This helps protect sensitive information, especially around proprietary technology.

- Employee Contracts and IP Assignment: Make sure that all employees and contractors have signed IP assignment agreements, ensuring any work they create for the company is owned by the business.

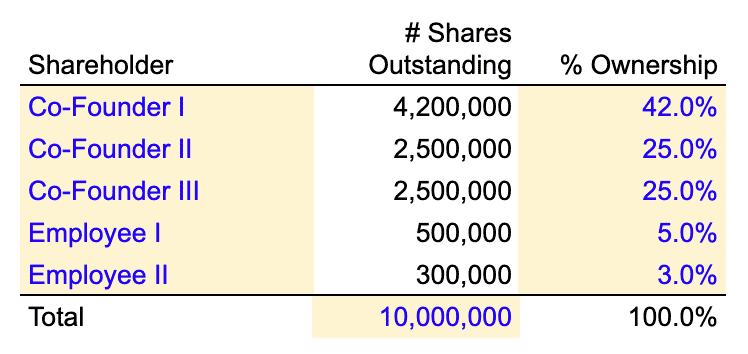

2. Have a Cap Table and Understand Dilution Risks

The capitalization table (cap table) details your startup’s ownership structure, listing all shareholders and their stakes. Keeping a well-organized, up-to-date cap table is essential, as it allows you to:

- Monitor Dilution: With each new funding round, founders experience equity dilution. Understanding this impact beforehand enables you to negotiate terms that preserve ownership and control.

- Ensure Transparency: An accurate cap table makes the equity structure clear to potential investors and minimizes the risk of misunderstandings.

- Plan for Future Rounds: Knowing your current equity structure allows you to map out future funding needs without overextending equity and risking founder or team morale.

3. Be Cautious with Term Sheets and Investment Agreements

Term sheets outline the initial terms of an investment deal. While not binding in every aspect, term sheets set the foundation for the final investment agreement and often include key terms that will appear in the final contracts. Key elements to review and protect your startup include:

- Valuation and Equity: Ensure the valuation aligns with your expectations and the level of control you’re willing to give up.

- Liquidation Preferences: A common term in venture capital deals, liquidation preferences define how proceeds are distributed if the company is sold. Single or double liquidation preferences mean investors get paid before founders and employees, so understanding these terms helps you avoid unexpected surprises.

- Board Control: Some investors seek board seats or observer rights. While having experienced investors on the board can be beneficial, be cautious about granting too much control, as it can lead to a loss of strategic decision-making.

4. Prepare Financial Projections with Care

Accurate and realistic financial projections are vital for building investor trust, but disclosing sensitive financial information also opens up risks if it falls into the wrong hands. Protect yourself by:

- Sharing Financials Selectively: Only share high-level financial information in initial meetings. As discussions progress, you can provide more granular details to serious investors under secure conditions.

- Confidentiality: Include confidentiality clauses when sharing detailed financial projections. This protects your sensitive data and reinforces your professionalism.

5. Choose Investors Wisely

Selecting the right investors goes beyond securing capital; it’s about forming partnerships that align with your vision and values. Before committing, evaluate potential investors for:

- Reputation: Research their track record with other startups, including any legal disputes or public controversies. Speaking with other founders who have worked with them can provide valuable insights.

- Experience: Investors with industry-specific experience or valuable networks can accelerate your growth. An investor’s background in your sector can make them more of a strategic partner than just a financial backer.

- Support: Assess whether the investor is known for being supportive and hands-on, especially during challenging times. The best investors are those who can contribute meaningfully without overstepping boundaries.

6. Protect Against “Investor Fatigue” in Later Rounds

Every funding round brings new investors and potential changes to ownership dynamics. Protecting yourself from “investor fatigue” — the reduced control and focus founders may feel after multiple rounds — can be achieved by:

- Prioritizing Clean Terms Early: Secure favorable terms in early rounds, as these tend to set a precedent for later investments. Avoid overly complex structures or heavy dilution that may hinder future fundraising or operations.

- Maintain Decision-Making Power: Avoid giving away too many board seats or decision-making rights too soon. Early control concessions may become problematic in future rounds, particularly when quick, agile decision-making is essential.

- Plan for Scalability: Ensure your business model and legal structure can scale with growth, making it easier to bring on investors without restructuring every round.

7. Stay Involved and Informed During the Process

Many founders entrust much of the fundraising process to attorneys or financial advisors, but staying informed and involved is essential. Being engaged helps ensure you understand each step and can spot potential issues early. Plus, actively participating in the process builds credibility with investors, showing them you’re committed to both protecting your startup and growing it strategically.

8. Seek Legal Counsel Early

Finally, one of the most important steps to protect your startup during fundraising is seeking experienced legal counsel. Specialized startup attorneys understand the nuances of venture capital, and their expertise can prevent costly missteps. Legal counsel can help review contracts, advise on negotiations, and ensure that you fully understand all aspects of the deals you’re considering.

Conclusion

Protecting your startup during fundraising involves a combination of strategic planning, careful evaluation of investors, and safeguarding your intellectual property and financial information. With a proactive approach and thorough understanding of each legal document and term, founders can navigate the fundraising process confidently. Remember, securing investment is about more than raising funds—it’s about establishing a partnership that will help you build a sustainable, successful business.