A pitch deck is a concise yet powerful presentation that helps you communicate your startup’s vision, business model, and growth potential to potential investors. It’s often the first opportunity to make a lasting impression, so crafting the perfect pitch deck is essential to capturing investors’ interest and securing funding. Here’s a comprehensive guide to creating a winning pitch deck that resonates with investors and gets your message across effectively.

1. Start with a Clear Structure

A successful pitch deck follows a logical flow, addressing all key aspects of your business in a clear, concise manner. Investors see dozens, if not hundreds, of pitches, so your deck should be easy to follow and impactful from the first slide. Here’s an ideal structure to use:

- Title Slide

- Problem

- Solution

- Market Opportunity

- Product/Service

- Business Model

- Go-to-Market Strategy

- Competitive Landscape

- Traction

- Financials

- Team

- The Ask

Now let’s break down each section in detail.

2. Title Slide

This is the first impression, so make it count. The title slide should be simple but engaging, containing your company name, logo, tagline, and contact information. The tagline should clearly convey what your business does in a few words. A strong visual or tagline that represents your company’s value proposition can grab attention right from the start.

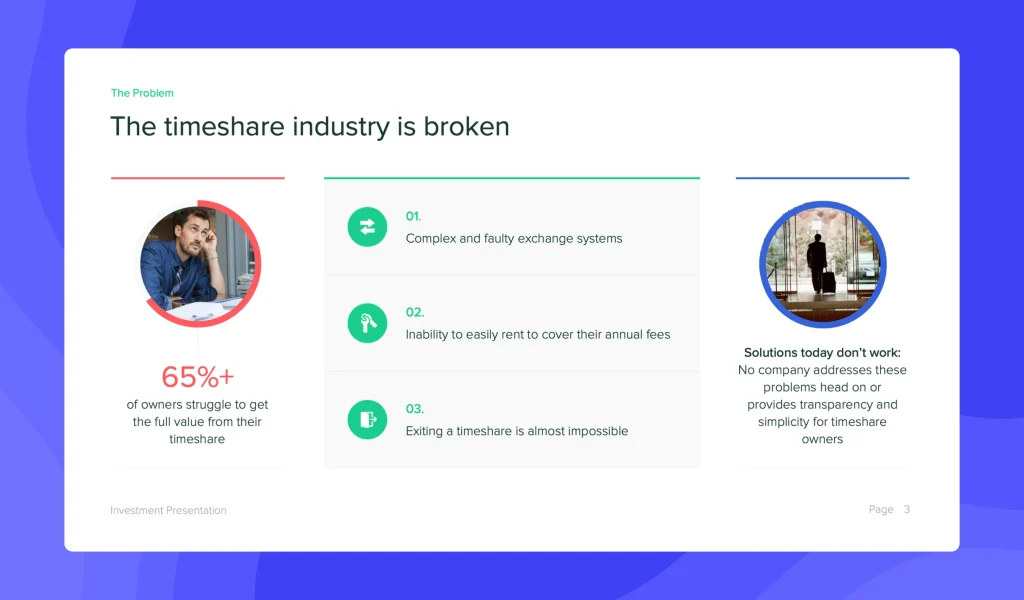

3. Problem

The problem slide sets the stage for why your business exists. Clearly articulate the pain point or challenge that your target market faces. Investors need to see that the problem is real, significant, and worth solving. Use data or real-life examples to validate the problem. The more relatable and pressing the issue, the better.

Tips:

- Be specific and avoid generic problems.

- Use visuals or storytelling to make the problem more relatable.

4. Solution

Now that you’ve framed the problem, show how your startup solves it. Present your product or service as the best solution to the problem. Focus on the key features and the unique value proposition that sets your solution apart from alternatives.

Tips:

- Explain how your solution is better, faster, or cheaper than existing options.

- Highlight any unique technology, patents, or proprietary elements.

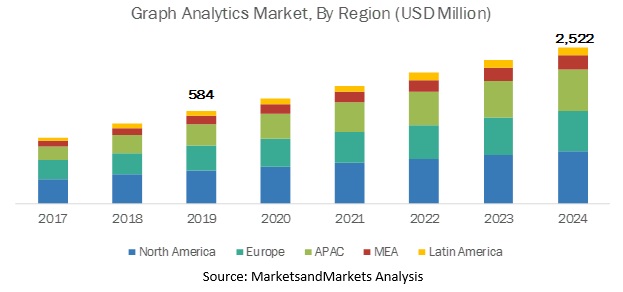

5. Market Opportunity

Investors want to know that you’re targeting a sizable and growing market. In this section, define the Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM). Use data and market research to support your claims.

Tips:

- Use charts or graphs to visually represent the market size and growth.

- Investors prefer large, scalable markets, so make sure to quantify the opportunity.

6. Product/Service

Now it’s time to showcase your product or service in more detail. Use visuals like screenshots, demos, or videos if possible. Highlight key features and explain how the product works. If possible, show how the product has already been validated by users or customers.

Tips:

- Make it easy to understand what the product does in a single glance.

- Focus on the user experience and the value delivered to customers.

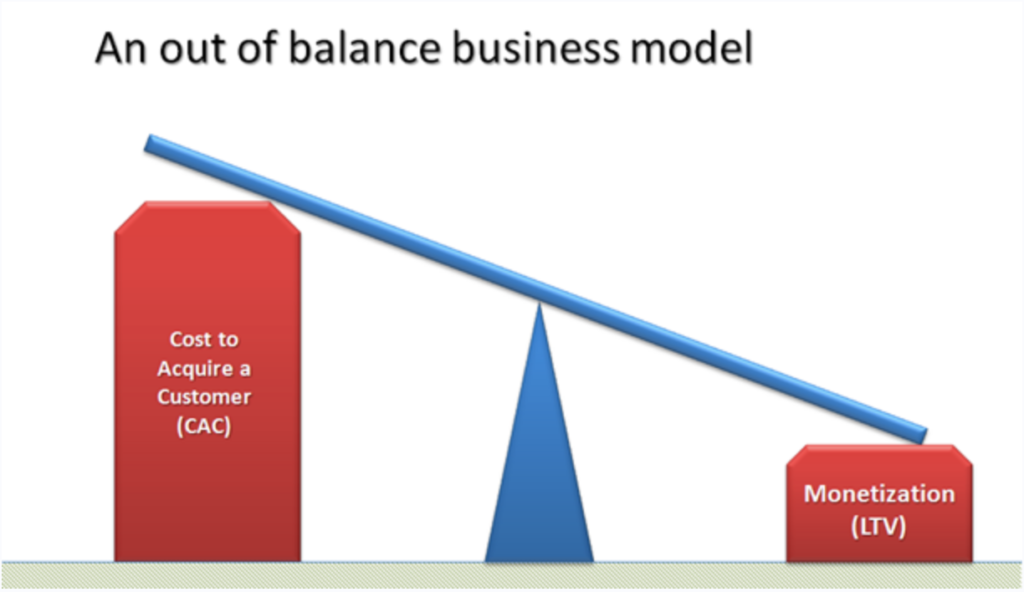

7. Business Model

In this slide, explain how your business plans to make money. Clearly outline your revenue streams, pricing strategy, customer acquisition costs (CAC), and lifetime value (LTV). The goal is to show investors that your business is financially viable and scalable.

Tips:

- Be specific about how you generate revenue (e.g., subscriptions, licensing, sales).

- Use simple, clear numbers or diagrams to explain your model.

8. Go-to-Market Strategy

Your go-to-market strategy outlines how you plan to acquire and retain customers. Investors need to know you have a clear plan for reaching your target market. This slide should cover marketing channels, sales strategies, partnerships, and timelines for customer acquisition.

Tips:

- Highlight any existing traction with marketing channels or customer acquisition.

- Show a clear understanding of how to reach your customers effectively.

9. Competitive Landscape

Every business faces competition. The key is to show investors that you understand your competitors and how you’ll differentiate yourself. Use a competitive matrix or positioning map to compare your startup against existing players based on key metrics (e.g., price, features, customer base).

Tips:

- Acknowledge direct and indirect competitors.

- Highlight your competitive advantage (e.g., unique features, proprietary technology, better user experience).

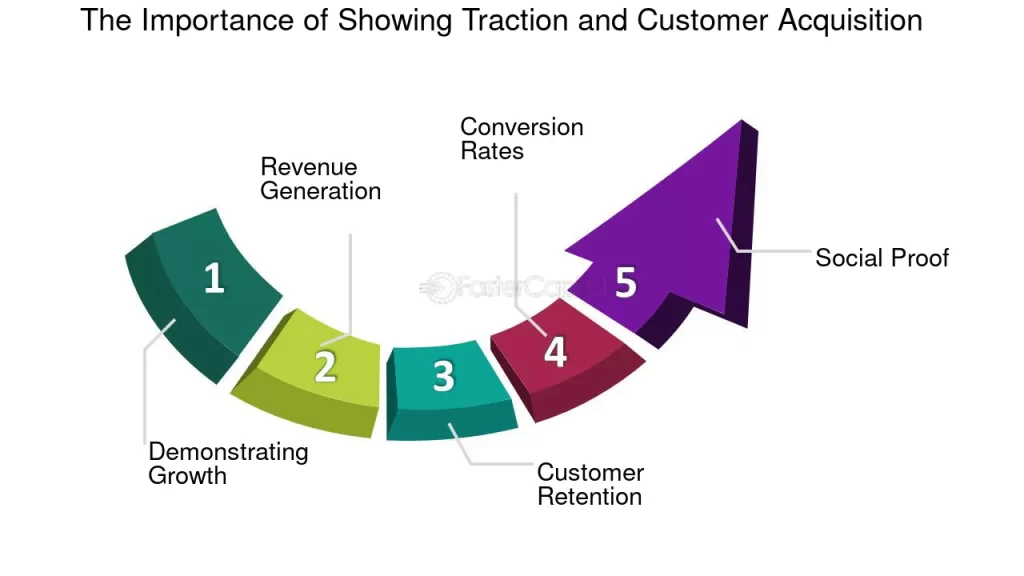

10. Traction

If your startup has already achieved notable milestones, this is where you shine. Traction could include revenue growth, user base expansion, partnerships, or product development milestones. Numbers speak louder than words, so present data that showcases momentum and progress.

Tips:

- Use metrics like Monthly Recurring Revenue (MRR), customer growth, or retention rates.

- Include testimonials, press coverage, or major partnerships if relevant.

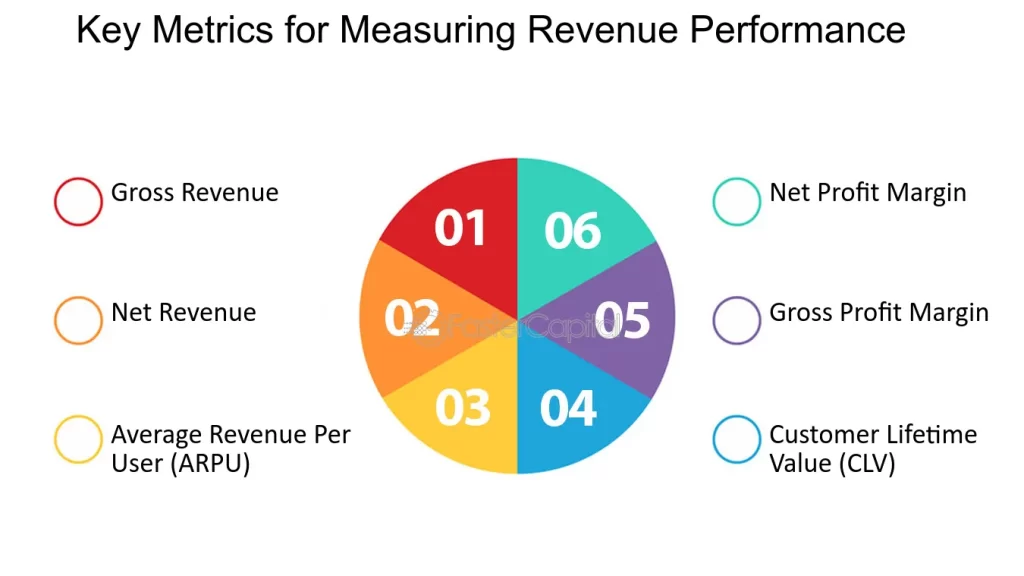

11. Financials

Investors will want to see your current financial health and future projections. Include a high-level overview of your income statement, balance sheet, and cash flow statement. Present financial forecasts for the next 3-5 years, along with your assumptions for growth.

Tips:

- Focus on key metrics like revenue, gross margin, and profitability.

- Use graphs or charts to make projections easy to digest.

12. Team

Investors often say they invest in people, not just ideas. Highlight your founding team and key hires. Showcase their relevant experience, domain expertise, and any previous successes. If possible, mention advisors or mentors with industry credibility who are supporting your startup.

Tips:

- Focus on why your team is uniquely positioned to execute the vision.

- Include short bios with key achievements, and avoid long text.

13. The Ask

End with a clear ask. State how much capital you’re raising, what you will use it for, and the expected outcomes from that investment. Be specific about how the funding will help you achieve your next milestones (e.g., product launch, expanding the sales team, entering a new market).

Tips:

- Make sure the ask is tied to specific goals and growth plans.

- Keep this slide simple and concise.

14. Design and Visuals Matter

A well-designed pitch deck is easier to digest and keeps investors engaged. Keep the design clean and professional, avoiding clutter or excessive text. Use visuals, charts, and icons to make the content more compelling and memorable.

Tips:

- Use a consistent color scheme and typography that aligns with your brand.

- Ensure slides aren’t too text-heavy—focus on clarity and brevity.

15. Practice Your Pitch

Finally, crafting the perfect deck is only half the battle—you need to deliver it effectively. Practice your pitch multiple times so you can confidently present your business in a clear and engaging way. Be ready to answer any questions investors may have.

Tips:

- Time yourself to ensure your pitch stays within a 10-15 minute window.

- Be prepared to dive deeper into financials, product details, or market research.

Conclusion

A well-crafted pitch deck is your gateway to securing the funding your startup needs. By following this guide and focusing on a clear structure, compelling visuals, and data-backed insights, you’ll increase your chances of making a lasting impression on investors. Remember, the perfect pitch deck not only tells your story but also demonstrates why your startup is a worthy investment.