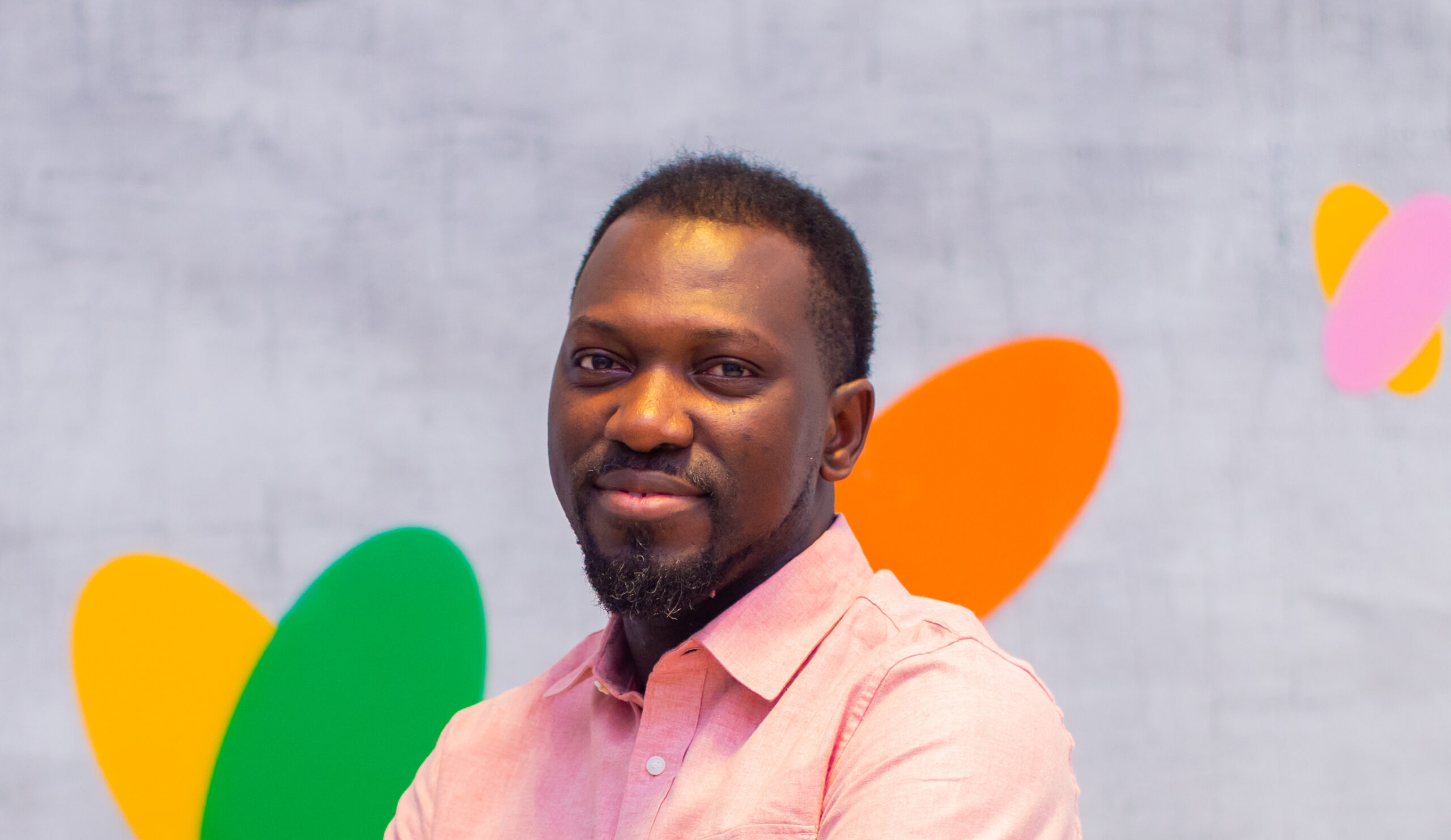

Olugbenga Agboola wasn’t supposed to succeed—at least, not according to those who said Africa wasn’t ready for a homegrown fintech giant. Yet, here he stands, the man behind Flutterwave, the billion-dollar company revolutionizing how money moves across the continent. His journey from corporate tech roles to founding one of the most valued startups in Africa is one of grit, genius, and a deep-rooted passion for solving the continent’s toughest challenges.

In 2016, when Flutterwave first launched, the odds were stacked against it. Africa’s payment landscape was fragmented, with each country using its own systems, riddled with regulations, and beset by inefficiencies. Moving money across borders wasn’t just difficult—it was expensive and unreliable. Agboola had a vision to change that. But how do you convince an entire continent to adopt a unified payment system, let alone trust a startup with their transactions?

What many don’t know is that Agboola’s mission wasn’t born out of a desire to build a flashy tech company. It was personal. He had witnessed firsthand the stifling effect poor financial infrastructure had on African businesses. Entrepreneurs with world-changing ideas were being held back because they couldn’t easily receive payments or scale beyond their local markets. Agboola’s ambition was simple: to tear down these barriers and empower African businesses to compete on a global scale.

The early days weren’t glamorous. Flutterwave’s journey was a constant struggle against the tide. Major financial institutions were skeptical. The company had to navigate a minefield of regulations across different countries, and competition from global fintech giants was fierce. Yet, Agboola never wavered. “You have to see the potential before anyone else does,” he once said. And that’s exactly what he did—pushed forward relentlessly when others would have given up.

One of the most critical moments in Flutterwave’s rise came when Agboola brokered partnerships with global companies like PayPal and Visa. These alliances were more than strategic; they were a statement that an African company could play on the same field as the world’s biggest financial players. The skeptics began to take notice.

But it wasn’t all smooth sailing. Agboola faced heavy criticism at various stages of Flutterwave’s growth. His aggressive expansion strategies and relentless push for market dominance ruffled feathers, and some insiders questioned whether Flutterwave could truly deliver on its promises. The pressure mounted, especially as the company expanded into new regions, facing regulatory scrutiny and stiff competition. Yet, through it all, Agboola remained calm. “You don’t grow by playing it safe,” he remarked in an interview, a philosophy that would come to define Flutterwave’s meteoric rise.

By the time Flutterwave hit unicorn status—valued at over $1 billion—it wasn’t just another fintech company. It had become a symbol of what was possible when innovation met resilience. Flutterwave had processed billions in transactions, connected thousands of businesses across Africa to the world, and empowered entrepreneurs to dream bigger.

While the headlines often focus on Flutterwave’s impressive numbers, the real story is Agboola’s vision. He didn’t just want to build a payment company; he wanted to reshape how Africa interacts with the global economy. And in doing so, he’s become a beacon of possibility for African tech. His leadership has shown that African businesses can innovate and compete on a global scale, not as underdogs, but as leaders.

Agboola’s journey is far from over. Today, he’s focused on taking Flutterwave to even greater heights, exploring new territories, and creating more groundbreaking solutions for African businesses. And while many are still catching up to what he’s already achieved, Agboola is already looking years ahead, plotting the next big move.

In his own words: “Africa is the future, and we’re just getting started.” Whatever that future holds, one thing is certain—Olugbenga Agboola will be right at the center of it.