Financial projections are a crucial part of any startup’s business plan. They provide a roadmap for your business’s financial future, helping you set goals, manage resources, and secure funding from investors. While projecting financials may seem daunting for new entrepreneurs, creating realistic and reliable financial forecasts is critical for long-term success. This step-by-step guide will walk you through the process of creating financial projections for your startup.

1. Understand Why Financial Projections Matter

Before diving into the numbers, it’s important to understand why financial projections are necessary:

- Attracting Investors: Investors need to see a clear financial path that demonstrates your startup’s profitability and growth potential. Projections give them insight into how their investment will yield returns.

- Guiding Decision-Making: Financial forecasts help you make informed decisions about budgeting, hiring, marketing, and product development.

- Planning for Growth: Projections allow you to estimate future cash flow and funding needs, helping you scale efficiently.

2. Identify Key Financial Statements

To build a solid set of financial projections, you need to prepare three key financial statements: the Income Statement, the Cash Flow Statement, and the Balance Sheet.

- Income Statement (Profit and Loss Statement): Shows your projected revenues, costs, and profits over a specific period (monthly, quarterly, or annually). It helps you track whether your startup will be profitable.

- Cash Flow Statement: Tracks the inflows and outflows of cash, ensuring you have enough liquidity to cover operating expenses and investments.

- Balance Sheet: Reflects your startup’s assets, liabilities, and equity at a particular point in time, showing the overall financial health of the business.

3. Project Revenue

Revenue projections are one of the most critical aspects of financial forecasting. Follow these steps to estimate your revenue:

- Determine Your Revenue Model: Identify how your business will make money. Will you sell products, offer services, charge subscription fees, or rely on advertising revenue?

- Estimate Sales Volume: Based on your market research, estimate how many units you will sell or how many clients you will secure. Start with conservative estimates and adjust as needed.

- Calculate Pricing: Set your pricing based on market standards, competitors, and the value your product offers. Multiply your estimated sales volume by your pricing to get your projected revenue.

Example: If you plan to sell 1,000 units of a product at $50 each, your projected revenue would be $50,000.

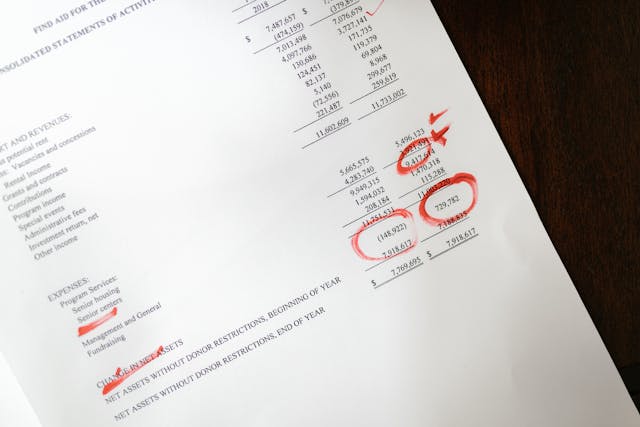

4. Estimate Costs

To create a realistic projection, it’s essential to calculate all the costs your startup will incur. These costs can be divided into two categories: fixed costs and variable costs.

- Fixed Costs: These are expenses that remain constant regardless of your sales volume, such as rent, salaries, insurance, and utilities.

- Variable Costs: These are costs that fluctuate with production or sales volume, such as materials, manufacturing, and shipping.

Once you’ve identified both fixed and variable costs, subtract them from your projected revenue to determine your gross profit.

Example: If your fixed costs are $20,000 and your variable costs are $10,000, your total costs would be $30,000. Subtracting that from $50,000 in revenue would leave you with a gross profit of $20,000.

5. Calculate Operating Expenses

Next, estimate your operating expenses, which include costs associated with running your business day-to-day. Common operating expenses include:

- Marketing and advertising

- Office supplies

- Software subscriptions

- Salaries and wages for non-production employees (administrative, marketing, etc.)

By subtracting operating expenses from your gross profit, you will arrive at your net profit, which gives you a clearer picture of your startup’s financial outlook.

6. Project Cash Flow

A cash flow projection shows when cash will be received and spent, providing insight into your startup’s liquidity. To create this projection:

- Cash Inflows: Include revenue from sales, loans, or investments. Account for the timing of payments from customers.

- Cash Outflows: Include all costs, such as rent, salaries, and supplier payments. Be mindful of when these expenses are due.

Example: If you expect $10,000 in sales in January but only collect $6,000 due to delayed payments, you will need to manage your cash flow accordingly to cover expenses.

7. Create a Balance Sheet

A balance sheet provides a snapshot of your startup’s assets, liabilities, and equity. Here’s how to build it:

- Assets: Include everything the business owns, such as cash, inventory, equipment, and accounts receivable.

- Liabilities: List all debts and obligations, such as loans, accounts payable, and wages owed.

- Equity: This represents the value of the ownership in the company (e.g., the founder’s investment).

Your balance sheet should always “balance” — meaning total assets must equal liabilities plus equity.

8. Create Projections for Multiple Scenarios

It’s important to prepare financial projections under different scenarios to account for uncertainties. Create:

- Best-Case Scenario: Assume higher-than-expected sales or lower costs.

- Worst-Case Scenario: Plan for lower revenue or unexpected expenses.

- Realistic Scenario: Use average estimates based on your research and expectations.

This will allow you to manage risks and make adjustments if your projections deviate from reality.

9. Use Financial Software or Templates

You don’t need to be an accounting expert to create solid financial projections. Many startups use tools like Excel, QuickBooks, or dedicated financial modeling software like LivePlan to simplify the process. These tools provide templates and automation that can make projections more accurate and easier to manage.

10. Review and Update Regularly

Financial projections are not a one-time exercise. As your startup evolves, so will your financial situation. Regularly review and update your projections based on real-world data to ensure that they reflect your current financial state and future outlook. This will allow you to adjust strategies, refine budgets, and make informed decisions based on accurate financial insights.

Conclusion

Creating financial projections for your startup is an essential step in planning for growth, managing resources, and securing investor interest. By following this step-by-step guide, you’ll be equipped to develop accurate and detailed financial forecasts that reflect your business’s potential. Remember, your projections should be flexible and regularly updated to stay aligned with the dynamic needs of your startup. Whether you’re seeking funding or mapping out future growth, strong financial projections provide the foundation for your startup’s success.