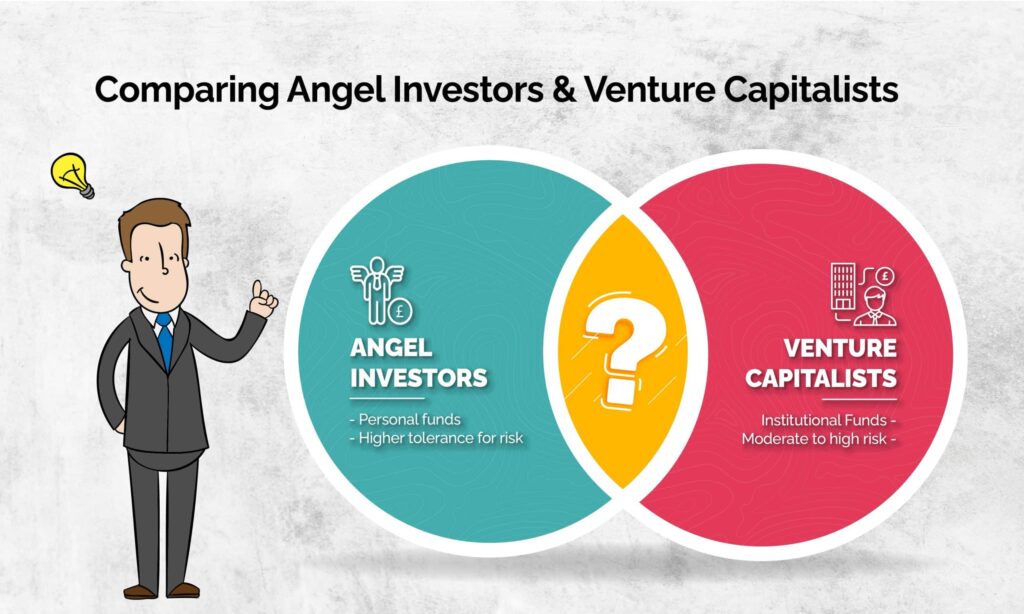

When you’re looking to raise funds for your startup, you’ll likely encounter two main types of investors: Angel Investors and Venture Capitalists (VCs). Both provide critical funding to early-stage companies, but they differ in their approach, funding capacity, and the type of support they offer. Understanding the key differences between angel investors and venture capitalists is essential to choosing the right funding path for your startup.

1. Who Are Angel Investors?

Angel investors are typically high-net-worth individuals who invest their own money in startups, usually at the early stages of development. They often invest in companies they are passionate about, and many are entrepreneurs themselves, using their personal experience to guide their investment choices.

Key Characteristics of Angel Investors:

- Personal Funds: Angels invest their own money, which can range from $5,000 to $100,000 per investment, though some may contribute more.

- Early-Stage Focus: Angels often invest in seed or pre-seed rounds, before the startup has gained significant traction or revenue.

- High Risk, High Reward: Angel investing is risky because these startups are often unproven. However, angel investors hope for a high return if the company succeeds.

- Hands-On Involvement: While some angel investors are hands-off, many like to play an active role in mentoring the startup, sharing their expertise, or joining the advisory board.

- Flexible Investment Terms: Angel investors are typically more flexible in their investment terms and may not demand significant equity or control in the business.

2. Who Are Venture Capitalists?

Venture capitalists (VCs) are professional investors who manage pooled funds from institutions, corporations, and individuals to invest in high-potential startups. Unlike angel investors, VCs typically invest larger sums of money and focus on startups that have already shown some level of growth or product-market fit.

Key Characteristics of Venture Capitalists:

- Institutional Funds: VCs manage funds raised from various sources, allowing them to make larger investments, often ranging from $500,000 to tens of millions of dollars in later funding rounds (Series A, B, C, etc.).

- Later-Stage Focus: VCs often invest in startups that have demonstrated product-market fit, customer traction, or revenue, reducing their exposure to early-stage risk.

- Portfolio Approach: Venture capitalists build portfolios of startups, accepting that some may fail while others may deliver outsized returns.

- Active Involvement: VCs typically take a hands-on approach, providing strategic guidance, introducing the company to industry contacts, and sometimes taking seats on the board of directors.

- Demand for Control: Venture capitalists often demand significant equity in exchange for their investment, and they may negotiate for more control over business decisions, including future fundraising and exit strategies.

3. Differences in Investment Size

One of the most significant differences between angel investors and VCs is the amount of capital they can provide.

- Angel Investors typically invest smaller sums. Their average investment is usually in the range of $5,000 to $100,000, though some “super angels” may invest more.

- Venture Capitalists, on the other hand, have much larger financial resources. Their investments often start at $500,000 and can go well into the millions, depending on the startup’s stage and growth potential.

Startups that are in their earliest stages may find it easier to secure funding from angel investors, while startups with proven traction may be better suited to approach VCs for larger rounds of funding.

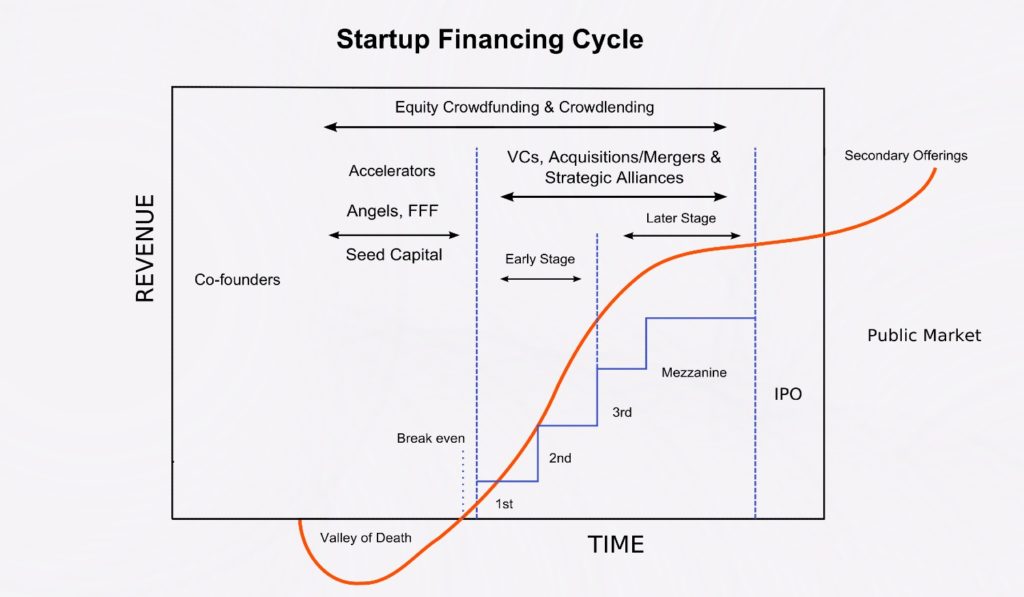

4. Stage of Investment

Angel investors and VCs tend to invest at different stages in a startup’s life cycle.

- Angel Investors: These investors usually participate in pre-seed and seed funding rounds, when the startup is in its infancy. They take on higher risks because many early-stage startups have not yet validated their market or business model.

- Venture Capitalists: VCs typically enter the scene in Series A or later rounds, once the startup has developed a product, acquired customers, and demonstrated some level of revenue. VCs prefer startups that are more established and have a clearer path to scalability and profitability.

5. Level of Involvement

Both angel investors and VCs may take an active role in helping the startup, but the level of involvement and their focus areas can differ.

- Angel Investors: Angels often play a mentoring role, especially if they have experience in the same industry. Since many are entrepreneurs themselves, they offer advice on operations, product development, and business strategy. They may not seek control or board seats, and their involvement tends to be more personal and hands-on.

- Venture Capitalists: VCs typically bring more structured, professional involvement. They may join the company’s board of directors or require regular updates on business performance. VCs leverage their extensive networks to connect startups with potential partners, customers, or even future investors. While their guidance can be invaluable, they also have higher expectations for performance and control.

6. Equity and Ownership

Both angel investors and VCs provide capital in exchange for equity in your company, but they differ in the amount of ownership they typically demand.

- Angel Investors: Angels are usually more flexible and take smaller equity stakes, often ranging from 5% to 20%. They may be more focused on helping you succeed than securing a large portion of the company.

- Venture Capitalists: VCs tend to take larger stakes in a company because they invest larger amounts of capital. In a typical VC deal, they may seek 20% to 40% ownership, depending on the stage of the company and the amount being invested. They may also insist on more influence over decision-making and future fundraising efforts.

7. Investment Horizon and Exit Strategy

Both angel investors and VCs invest with the expectation of a significant return, but their timelines and exit strategies can vary.

- Angel Investors: Angels typically have a longer-term investment horizon, willing to wait 7 to 10 years or more for their return. They are more patient, understanding that early-stage companies take time to grow and mature.

- Venture Capitalists: VCs, by contrast, are usually looking for quicker exits, such as through acquisitions or IPOs, within 3 to 7 years. They are often more focused on scaling rapidly and achieving a high-growth exit strategy, which can put pressure on the startup to meet aggressive targets.

8. Decision-Making Power

Angel investors are generally less concerned with control than VCs.

- Angel Investors: Angels may provide advice and mentorship but typically don’t seek decision-making power over your business. They trust the founders to execute their vision.

- Venture Capitalists: VCs often demand more control, including board seats and a say in key decisions, especially when it comes to future fundraising, hiring executives, and even exit strategies. Their goal is to protect their investment and ensure the company scales in a way that maximizes returns.

Conclusion

Both angel investors and venture capitalists play crucial roles in the startup ecosystem, but they serve different purposes based on the stage and needs of the business. Angel investors are ideal for early-stage companies looking for smaller investments and more flexible terms, often combined with mentorship and industry expertise. On the other hand, venture capitalists are better suited for startups that have already gained traction and are ready to scale rapidly, with a focus on large investments and strategic growth.

Choosing between angel investors and VCs depends on your startup’s current stage, the amount of capital needed, and the level of involvement you’re comfortable with. Understanding these differences can help you make informed decisions and find the right financial partners to drive your company forward.