Presenting financials in a pitch deck can be one of the most critical—and challenging—parts of delivering a compelling pitch to investors. The financials are what ground your vision, offering investors a clear view of the profitability, scalability, and viability of your business. This is where you substantiate your story with numbers, showing potential returns and highlighting key metrics that align with the investor’s interests. Here’s a step-by-step guide to effectively presenting financials in a pitch deck.

1. Start with a Snapshot of Key Metrics

Begin with an overview of your company’s key metrics to quickly set the financial stage. Highlight metrics such as:

- Revenue and growth rate: This includes both current revenue and projected growth over the next few years.

- Customer Acquisition Cost (CAC): Shows how much you spend to acquire a new customer.

- Lifetime Value (LTV): Represents the total revenue expected from a customer over their lifetime.

- Gross Margin: Demonstrates profitability before operating expenses.

- Monthly Recurring Revenue (MRR) or Annual Recurring Revenue (ARR): Essential for subscription-based or SaaS businesses.

These metrics will act as a “quick read” of your financial health, attracting investors’ attention right from the start.

2. Forecast Your Revenue and Growth

The revenue projection slide should show how your company expects to grow over the next 3-5 years. This projection should be ambitious yet grounded in real data and market research. Break it down by revenue streams if you have multiple products or services, as this will show investors how different areas contribute to your growth.

To make this projection credible, show how you calculated your numbers. Outline assumptions for factors such as market penetration, new customer acquisition, and expected expansion into other markets or demographics.

3. Expense Projections: Transparency is Key

Investors are just as interested in how you spend money as they are in how you make it. An expense projection slide helps illustrate your burn rate, or the pace at which you use cash to fund your operations. This should include:

- Cost of Goods Sold (COGS): Direct costs associated with producing your product or delivering your service.

- Operating Expenses: Key categories like R&D, sales and marketing, and general administration.

- Customer Acquisition Cost (CAC): Shows that you understand the costs of scaling.

By breaking down expenses in this way, you show that you understand your costs, enabling investors to assess your business model’s efficiency.

4. Outline Your Financial Model

Include a concise summary of your financial model to help investors understand how you plan to generate revenue, manage costs, and ultimately achieve profitability. This slide should include:

- Revenue Model: Describe how your business generates revenue—whether it’s through subscription fees, licensing, product sales, or another method.

- Growth Levers: Highlight specific strategies you’ll employ to drive growth, such as increasing market share, expanding into new territories, or introducing complementary products.

- Scalability: Explain how your business model supports scaling up while controlling costs and improving margins over time.

This will help investors visualize how your company’s core business model works and why it has the potential to grow sustainably.

5. Cash Flow Projections and Burn Rate

Next, outline your cash flow projections. Cash flow is essential for startups since it directly impacts your ability to operate without running out of funds. This slide should cover:

- Monthly or Quarterly Cash Flow: Showing cash inflows and outflows over time.

- Burn Rate: A monthly burn rate calculation to indicate the rate at which your company spends cash. A lower burn rate generally signals more financial discipline and a longer runway before you’ll need additional funding.

Also, provide your current runway—the number of months you can operate with your existing cash. Investors want to know how long their investment will last before you’ll need to raise more capital, so present these numbers with clarity.

6. Highlight Milestones Tied to Financial Goals

Milestones are powerful indicators of your roadmap and show investors the major achievements you’re aiming for with their funding. This slide should link specific milestones to your financial projections, such as:

- Customer Growth Targets: Reaching a certain number of customers by a particular quarter.

- Revenue Milestones: Hitting significant revenue benchmarks, such as reaching $1 million ARR.

- Market Expansion: Scaling into new markets, industries, or demographics.

- Product Launches or Enhancements: Key developments that will drive growth and add value to the business.

By tying these milestones to financial goals, you show investors that their capital will be used effectively to reach specific outcomes.

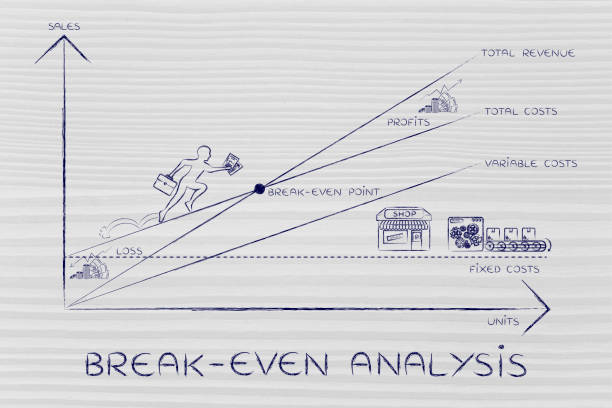

7. Conduct a Break-Even Analysis

For many investors, understanding when a company plans to achieve profitability is a crucial factor in the decision-making process. A break-even analysis demonstrates when your revenue will cover costs, providing a tangible goalpost on the road to profitability.

Highlight the point at which your company expects to break even, based on projected revenue and expenses. Investors will see this as a vital checkpoint for understanding the path to sustainable profitability.

8. Address Risks and Mitigation Strategies

Financials in a pitch deck shouldn’t overlook potential risks. Demonstrate that you’ve thought through what could go wrong and have a plan for managing those risks. Potential risks might include:

- Market Saturation: If your target market reaches its capacity.

- Regulatory Changes: If your industry is highly regulated, such as healthcare or fintech.

- Economic Downturns: Explain how you plan to remain resilient during economic shifts.

Highlighting these risks, along with strategies for mitigating them, reassures investors that you are prepared to navigate challenges.

9. Show Your Funding Ask and Use of Funds

Finally, present the specific amount of capital you’re looking to raise and how you intend to use it. This slide should be as clear and specific as possible. Break down the funding ask by categories, such as:

- Product Development: Allocating funds to engineering, R&D, or product expansion.

- Marketing and Sales: Boosting customer acquisition and brand awareness.

- Hiring and Operations: Expanding your team and improving operational capacity.

- Working Capital: Ensuring liquidity for day-to-day operations.

Investors want to see that their money will go toward initiatives that increase the company’s value, drive growth, and help you reach profitability faster.

Final Tips for a Winning Financial Presentation in a Pitch Deck

- Keep It Visual: Use charts and graphs instead of dense tables to make complex data easy to digest.

- Be Concise: Focus on the most compelling numbers, trends, and projections to keep your pitch deck streamlined and impactful.

- Know Your Numbers: Be prepared to dive into details during the Q&A. Investors may ask for further explanations, so make sure you can discuss each assumption and projection with confidence.

- Tell a Story: Integrate your financials into the larger narrative of your business’s vision and strategy.

Conclusion

A well-structured financial section can make or break a pitch deck. Investors are looking for concise, realistic projections that show your understanding of your business model, market dynamics, and financial path. By carefully presenting key metrics, realistic projections, and a clear funding strategy, you’ll create a compelling case that aligns with the expectations of potential investors.