Valuing a startup at an early stage can be challenging, especially when the company is pre-revenue or has limited financial history. Unlike mature businesses that can rely on established metrics like revenue, profits, or cash flow, early-stage startups often have little more than an idea, a team, and a vision. However, it’s crucial to establish a fair valuation for fundraising, attracting investors, and setting the foundation for future growth. Here’s how to approach the complex process of valuing your startup at an early stage.

1. Understand What Investors Look for in Valuation

Before diving into the methods of valuation, it’s important to recognize what investors typically focus on when evaluating early-stage startups:

- Team: The founding team is often one of the most important factors for investors. A strong, experienced, and complementary team can significantly increase a startup’s value.

- Market Opportunity: The size and growth potential of the target market play a critical role. Investors prefer startups with scalable business models and large addressable markets.

- Product/Technology: If you have a unique or defensible product, technology, or intellectual property, it adds to the startup’s value.

- Traction: Even if you’re pre-revenue, demonstrating early customer interest, partnerships, or a growing user base can positively influence valuation.

- Vision: Investors often look at the founder’s vision and the long-term potential for the company to disrupt industries or create new market opportunities.

2. Common Methods for Valuing Early-Stage Startups

There is no single method to value an early-stage startup, but several common approaches are used, each with its strengths and limitations.

a. Berkus Method

The Berkus Method is designed specifically for early-stage startups and is based on a combination of qualitative and quantitative factors. It assigns a value to different aspects of the startup, such as:

- Sound Idea (basic value): up to $500,000

- Prototype: up to $500,000

- Quality of Management Team: up to $500,000

- Strategic Relationships: up to $500,000

- Product Rollout or Sales: up to $500,000

This method results in a rough valuation that caps at $2 million to $2.5 million for a pre-revenue startup.

b. Scorecard Valuation Method

The Scorecard Method compares your startup to other startups in the same region and industry. You start with an average valuation (based on similar startups) and then adjust up or down depending on factors such as:

- Team Strength (0-30%)

- Size of Opportunity (0-25%)

- Product/Technology (0-15%)

- Competitive Environment (0-10%)

- Marketing/Sales Channels (0-10%)

- Need for Additional Investment (0-5%)

For example, if similar startups in your region are valued at $3 million, and you rate highly across these categories, you might adjust your valuation upward to reflect the strengths of your business.

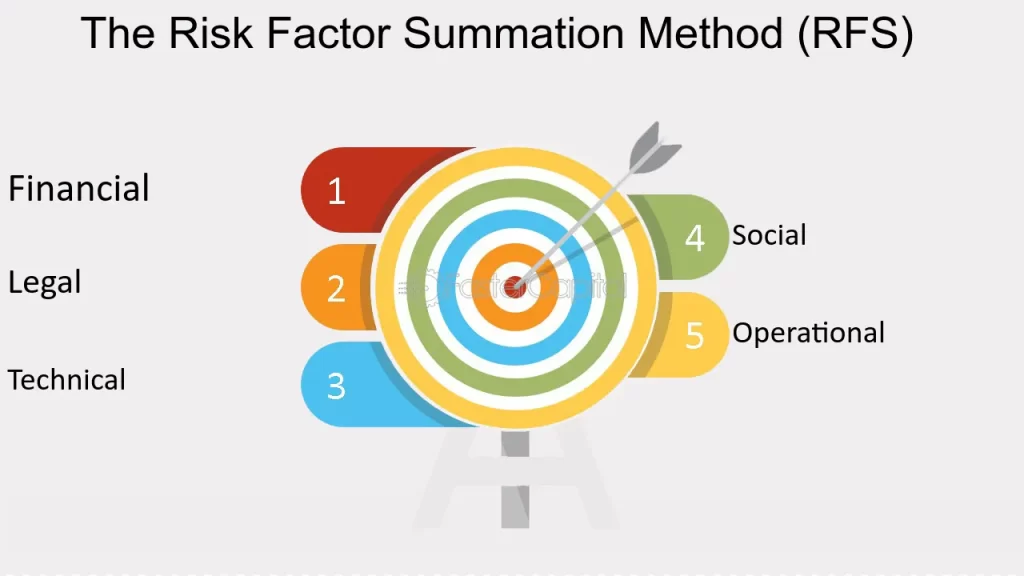

c. Risk Factor Summation Method

This method adjusts a base valuation (usually derived from comparable startups) by assessing the risks involved in various areas of the business. Common risk categories include:

- Management Risk

- Market Risk

- Competition Risk

- Technology Risk

- Operational Risk

- Legal/Regulatory Risk

- Funding/Cash Flow Risk

Each risk is assigned a score, and the total score adjusts the base valuation. If a startup has high risks, the valuation will be lower, and if risks are mitigated, it could increase the valuation.

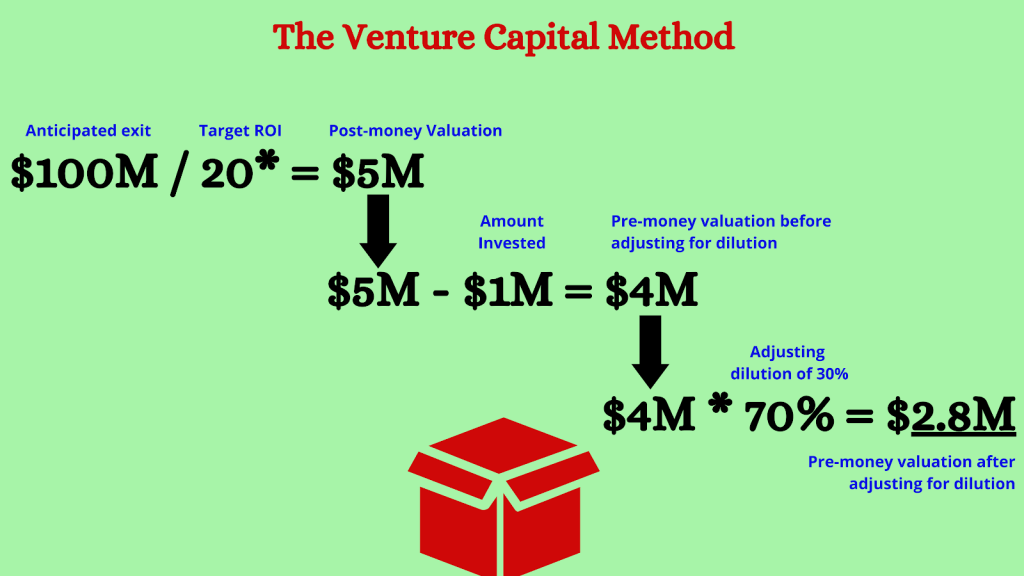

d. Venture Capital (VC) Method

The VC Method is commonly used by venture capitalists to estimate the post-money valuation of a startup. It starts with estimating the potential future value of the company at the time of exit (such as an acquisition or IPO) and works backward.

Steps involved:

- Estimate Future Value: Assume the startup will exit in 5-7 years and estimate the exit value based on comparable companies.

- Expected Return on Investment (ROI): VCs typically seek a return of 10x to 30x their investment, depending on the risk.

- Pre-Money Valuation: This is calculated by dividing the exit value by the expected ROI.

For example, if the expected exit value is $100 million and the VC is seeking a 10x return, the pre-money valuation would be $10 million.

e. Comparable Transactions Method

This method involves looking at recent funding rounds for similar startups in your industry and location. If companies at a similar stage in your sector are raising capital at valuations of $5 million, that gives you a benchmark to set your valuation.

However, you need access to accurate data about comparable deals, which can sometimes be hard to obtain.

3. Factors That Impact Valuation

While the above methods provide frameworks for valuation, several factors can significantly influence how investors value your startup:

- Market Trends: If your startup is in a “hot” sector, such as AI, fintech, or biotech, you may benefit from inflated valuations driven by high investor demand.

- Geography: Startups in regions like Silicon Valley or New York often receive higher valuations compared to those in less established tech hubs.

- Competitive Landscape: If you have little competition, your valuation might be higher due to a larger share of the market opportunity.

- Burn Rate: Investors will evaluate how quickly you’re burning through cash. A high burn rate may lower your valuation if it suggests a need for frequent fundraising.

4. Balancing Valuation Expectations

It’s important to balance your valuation expectations with what’s realistic. Overvaluing your startup may deter potential investors or set you up for challenges in future fundraising rounds if you don’t meet growth expectations. On the other hand, undervaluing your company could result in giving away too much equity early on, which can dilute your ownership and control in the long term.

5. Communicating Your Valuation to Investors

Once you’ve determined a valuation, you’ll need to clearly communicate it to investors. Be prepared to explain how you arrived at the figure, the assumptions you’ve made, and the rationale behind your projections. Investors will want to see that your valuation is backed by data and a deep understanding of your market and business model.

It’s also critical to be open to negotiation. Investors may have a different perspective on valuation based on their experience, and flexibility can help you close a deal that works for both parties.

Conclusion

Valuing an early-stage startup is more art than science, given the lack of historical data and the high level of uncertainty. However, by using established methods like the Berkus Method, Scorecard Valuation, or the VC Method, and considering factors such as team strength, market opportunity, and product potential, you can arrive at a fair valuation for your business. The key is to approach the process thoughtfully, balance your expectations, and remain flexible during negotiations with investors. With the right valuation, you’ll be well-positioned to raise the capital you need to grow your startup.