Startup growth and development necessitate capital raising. It offers the requisite resources to realise concepts, expand operations, and penetrate new markets. Nevertheless, the fundraising environment can be intricate and difficult to navigate. This exhaustive guide will assist you in comprehending the key players, legal structures, financial statements, projections, valuation methods, and stages of funding that are essential for successful fundraising.

Funding Types

Fundraising encompasses a variety of funding sources, each with its own unique set of advantages, disadvantages, and characteristics. Comprehending these alternatives will facilitate the selection of the optimal option for your startup.

- Funding through equity

Equity funding entails the exchange of capital for a portion of your company’s ownership. Investors acquire shares and, consequently, acquire partial ownership of your startup.

Advantages:

• There is no requirement for repayment

• Investors may contribute valuable connections and expertise.

Cons:

• Potential loss of control

• Dilution of ownership

2. Debt financing

Debt funding entails the acquisition of funds that must be repaid with interest. Loans and bonds are prevalent varieties.

Advantages:

• Interest payments are tax-deductible

• No ownership dilution

Cons

• Requirement to repay

• Potential constraint on cash flow

3. Grants Governments, foundations, or organisations provide non-repayable funds to support specific programs or initiatives.

Pros:

• There is no equity dilution or repayment.

• Provides assistance with particular initiatives

Cons:

• Competitive application process

• Frequently accompanied by rigorous reporting requirements

4. Crowdfunding

Crowdfunding is a process that entails the collection of small sums of money from a large number of individuals, typically through online platforms.

Pros:

• Widespread audience reach

• Ability to establish and expand customer base

Con:

• Time-consuming campaign management

• Funding outcome that is uncertain

Funding Stages

Typically, startups undergo a series of funding stages, each of which serves distinct requirements and objectives.

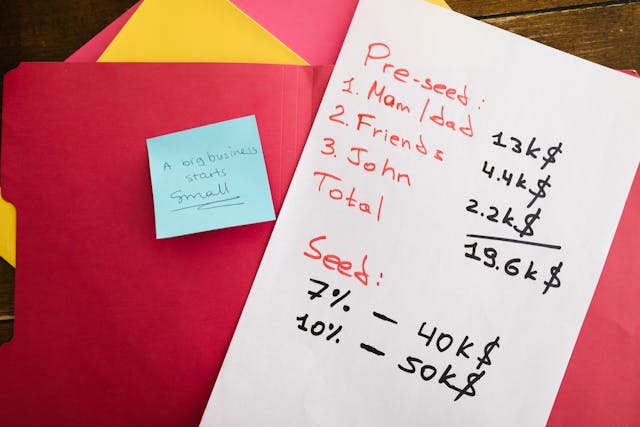

- Pre-seeding

The pre-seed stage is the initial phase of funding, frequently involving personal savings, family, and acquaintances. It is employed to create an initial business model or prototype.

- The seed

Seed funding enables entrepreneurs to conduct market research, refine their product, and establish a team. Angel investors, incubators, and early-stage venture capitalists comprise investors at this juncture.

- A Series

The product is optimised, the user base is expanded, and revenue is generated through Series A funding. It entails more substantial investments from venture capital firms.

- Series B, C, and Beyond

Scaling operations, market expansion, and product diversification are supported by subsequent funding cycles (Series B, C, etc.). Venture capitalists and private equity firms frequently contribute substantial investments to these rounds.

Primary Players

It is essential to comprehend the primary actors in the fundraising ecosystem in order to establish relationships and secure capital.

Angel investors

Angel investors are high-net-worth individuals who provide early-stage funding in exchange for equity. In addition to capital, they provide mentorship and industry connections.

Venture capitalists (VCs)

Venture capitalists (VCs) are professional investment firms that offer substantial funding in exchange for equity. They typically invest in high-growth ventures that have the potential to generate substantial returns.

Incubators and Accelerators

Funding, mentorship, and resources are provided to early-stage ventures by accelerators and incubators. Accelerators offer intensive, short-term programs to expedite growth, while incubators concentrate on the development of startups over a lengthier period.

Legal Frameworks and Consequences

It is essential to select the appropriate legal structure for your firm in order to facilitate fundraising, as it impacts investor appeal, liability, and taxation.

Common Legal Frameworks

• Sole Proprietorship: A straightforward and straightforward entity to establish; however, it does not provide liability protection.

• Partnership: Similar to a sole proprietorship, but with multiple owners.

• Limited Liability Company (LLC): Provides liability protection and flexible tax options.

• Corporations (C-Corp or S-Corp): Provide liability protection and are preferred by investors due to their capacity to issue stock.

Legal Consequences

• Equity Dilution: The issuance of new shares results in a reduction of the existing ownership.

• Investor Rights: Investors may require particular rights and protections.

• Compliance: It is imperative to comply with securities laws and regulations.

Financial Statements and Forecasts

It is essential to provide precise financial statements and projections in order to attract investors and showcase the potential of your startup.

Key Financial Statements

• Income Statement: Displays revenue, expenses, and profits over a specified time frame.

• Balance Sheet: Offers a concise overview of the equity, liabilities, and assets of your startup.

• Cash Flow Statement: Emphasises liquidity by monitoring cash inflows and outflows.

Financial Forecasts

Formulate financial projections that are plausible in order to illustrate the potential for future growth. Incorporate cash flow projections, expense estimates, and revenue forecasts. Make conservative assumptions and be prepared to provide justifications.

Methods of Valuation

Negotiating with investors and obtaining favourable terms necessitates an accurate valuation of your startup.

Valuation Methods That Are Commonly Used

• Comparable Company Analysis (CCA): A comparison of your startup to analogous companies.

• Discounted Cash Flow (DCF): A method for estimating the present value of prospective cash flows.

• Precedent Transactions: Examines recent acquisitions of comparable organisations.

• The venture capital method involves estimating the exit value and working backward to estimate the present value.

Valuation Factors

• Market Opportunity: The size and growth potential of your intended market.

• Traction: Revenue, customer base, and growth rate.

• Team: The track record and experience of your founders and team.

• Technology: Intellectual property and innovation.

A comprehensive knowledge of the various types of funding, stages, key actors, legal frameworks, financial statements, and valuation methods is necessary to navigate the fundraising landscape. Securing the capital necessary to realise your vision and positioning your startup for success can be accomplished by mastering these elements. This guide offers the necessary foundation to confidently navigate the fundraising process, whether you are just beginning or preparing for your next funding round.