One of the most important documents you’ll need when attracting investors is a well-structured cap table. A capitalization table, or cap table, provides a detailed breakdown of your company’s ownership, including shareholders, stock options, and convertible securities. Investors use this document to assess the ownership structure and determine their potential stake in your business. If your cap table is organized properly, it can help attract investment; chaotic or unclear could scare investors away.

What is a Cap Table?

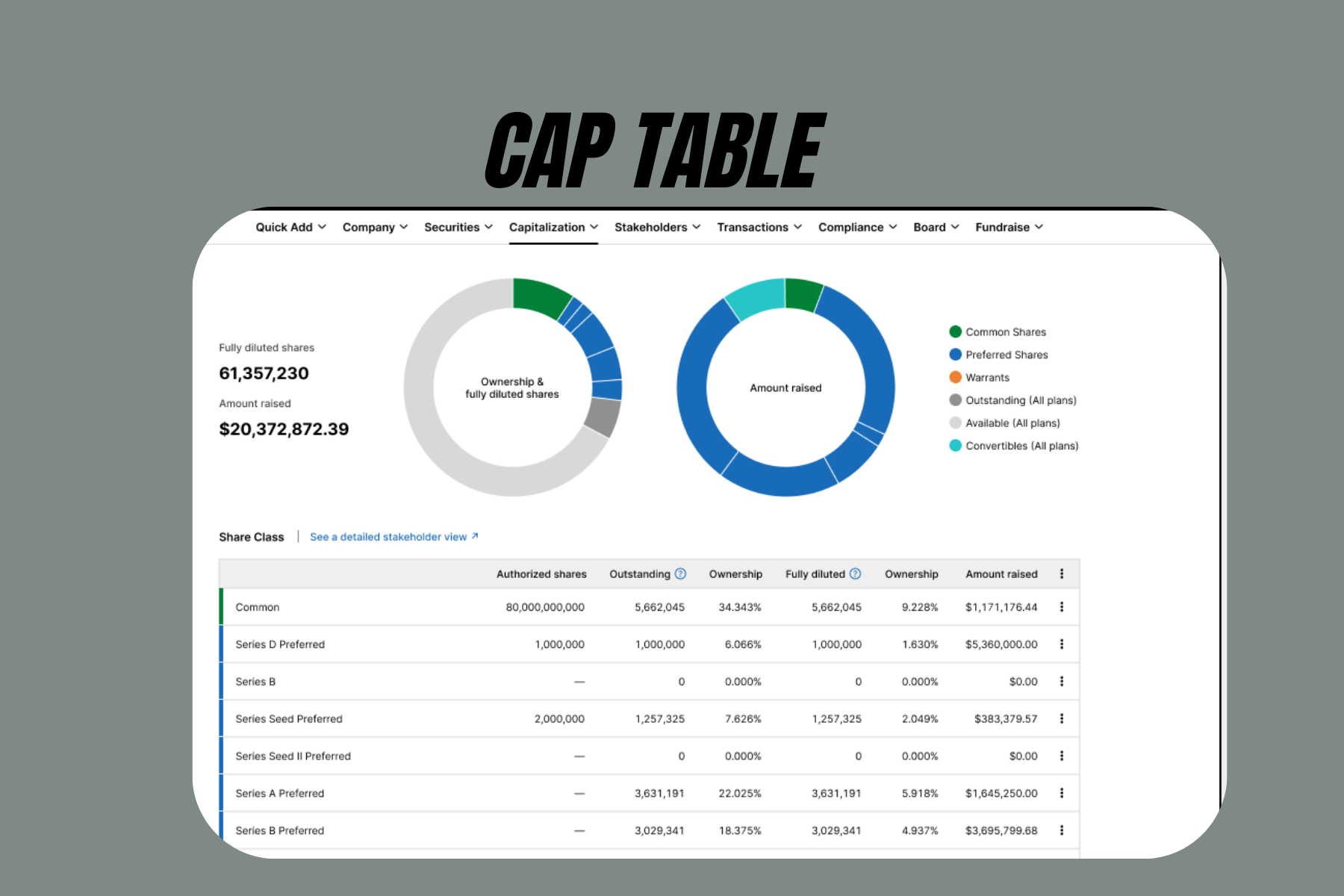

A cap table is essentially a spreadsheet or document that outlines who owns what in your company. It provides a snapshot of the company’s equity structure, detailing the percentage of ownership and the types of securities held by various shareholders. The cap table typically evolves over time as a company raises funds, issues new shares, and grants options to employees or advisors.

Key information often included in a cap table:

- Shareholder names and the class of shares they own

- Number of shares held by each investor or shareholder

- Percentage ownership of each shareholder

- Types of shares (e.g., common stock, preferred stock)

- Details of convertible securities such as stock options, warrants, or convertible notes

- Equity dilution as new shares are issued during fundraising rounds

Why a Well-Structured Cap Table is Important

A clean, accurate, and well-maintained cap table is crucial for attracting investors. Here’s why:

- Transparency and Trust: Investors want to know exactly how the company’s equity is distributed before they commit any capital. A clear cap table builds transparency and trust, as it shows all current shareholders and their respective stakes in the company.

- Ownership Clarity: A well-structured cap table clearly outlines the equity ownership for all parties involved, from founders to employees and investors. This helps investors see where they stand in relation to other shareholders and understand how their potential investment will fit into the overall structure.

- Prevents Dilution Surprises: Investors are concerned about the risk of dilution, where the issuance of new shares reduces their percentage of ownership. A properly structured cap table shows how much room is left for future dilution and provides transparency around how equity is likely to evolve during subsequent funding rounds.

- Determining Valuation: A cap table helps investors calculate your company’s current and post-money valuation (the value of the company after the investment). This is key for them to understand their potential returns. The cap table allows them to model different scenarios, such as the impact of issuing new shares or converting convertible notes into equity.

- Negotiating Terms: A well-structured cap table allows for more informed negotiation between founders and investors. It ensures everyone has a clear understanding of ownership percentages, voting rights, and exit scenarios, which can speed up negotiations and lead to more favorable investment terms.

Key Components of an Investor-Ready Cap Table

To attract investors, your cap table should be easy to understand, well-organized, and accurate. Here are the critical components to include:

- Founders and Early Shareholders: Clearly list all founders and early shareholders, along with the number of shares they own. Investors want to know how much equity founders still hold, as this indicates their level of commitment to the business.

- Equity Distribution: Break down the ownership structure by share class. Investors often look for the proportion of common shares (typically held by founders and employees) versus preferred shares (typically issued to investors). Include any convertible notes or warrants, as these can impact future equity distribution.

- Stock Options and Employee Equity Pool: Highlight any shares reserved for employee stock options or future equity incentives. Investors will assess the size of your employee stock option pool to ensure there’s enough equity left to incentivize key hires without excessive dilution.

- Preferred Shareholders: If your company has issued preferred stock in previous funding rounds, detail the ownership and rights of preferred shareholders, including any liquidation preferences, voting rights, or conversion terms. These details are critical as preferred stock often has terms that differ from common shares.

- Convertible Securities: Include any convertible notes, SAFE (Simple Agreement for Future Equity) agreements, or other convertible securities that could impact equity distribution during future financing rounds. These securities can significantly affect the ownership structure once converted, so they must be factored into the cap table.

- Pre-Money and Post-Money Valuations: Show both the current (pre-money) valuation of your company and the anticipated post-money valuation after the investment round. Investors need to see how their capital infusion will affect the overall value and ownership breakdown.

- Ownership Percentages: Clearly indicate the percentage ownership each shareholder holds before and after any investment round. Investors need to understand how much of the company they will own, and this percentage is critical to their decision-making.

How to Structure a Cap Table to Attract Investors

- Use a Simple, Intuitive Format: Your cap table should be easy to read and navigate. Avoid overly complicated formulas or cluttered layouts. Many startups use spreadsheet software like Excel or Google Sheets, but cap table management software (e.g., Carta, Capshare) is a more efficient option as it scales with your business.

- Be Up-to-Date: Keep your cap table current. As your business grows, you will need to update it to reflect new funding rounds, stock option grants, or ownership changes. An outdated cap table could create confusion and raise red flags with investors.

- Show Future Scenarios: Investors want to understand how future events, such as additional funding rounds or employee stock option exercises, will impact their ownership. Providing scenario analysis—where you show how the cap table might change in different growth scenarios—can be a helpful tool.

- Account for Future Dilution: A well-structured cap table anticipates future equity dilution and shows how new shares, employee stock options, and convertible securities will affect ownership. This gives investors a clearer picture of their long-term stake in the company.

- Address Investor Rights: Make sure the cap table accounts for any rights associated with different classes of shares. For example, preferred shareholders may have liquidation preferences or anti-dilution provisions. These rights should be clearly visible so that investors understand their potential protections.

Common Cap Table Mistakes to Avoid

- Neglecting Employee Options: Forgetting to account for employee stock options or not setting aside enough equity for future employees is a common mistake that can hurt your ability to attract talent and investors. Make sure you have a clear plan for your option pool and communicate it clearly on the cap table.

- Overcomplicating the Cap Table: Keep it simple. Too much complexity can confuse investors and lead to longer due diligence processes. Focus on presenting the essential information in a clear, straightforward format.

- Not Planning for Future Rounds: Many startups fail to plan for future funding rounds and end up with significant dilution. Show investors that you have a strategy for managing future equity distribution and dilution by forecasting future rounds on the cap table.

Conclusion

A well-structured cap table is a powerful tool for attracting investors. It provides transparency, facilitates negotiation, and helps investors understand their potential stake in your company. By keeping the cap table simple, accurate, and up-to-date, you demonstrate professionalism and readiness to scale your business. For founders looking to secure funding, having a cap table that clearly outlines ownership and anticipates future changes is a critical step toward building investor confidence and closing successful fundraising rounds.